Representative Example: £13,000 over 66 months, 34.9% APR fixed. Monthly payment £406.79. Annual interest rate 30.31% fixed. Interest payable £13,848.14. Total repayable £26,848.14.

Minimum repayment period: 36 months. Maximum repayment period: 120 months. Maximum APR 37.9%.

Personal loan uses

Our loans can be used for many purposes including...

Personal loan criteria

3 steps to applying for a Personal loan

Complete the online application and authorise us to review your bank account transactions via Open Banking.

Carry out an affordability assessment with a member of our lending team.

A few final checks and then we’ll transfer the loan funds.

Frequently asked questions about Personal loans

Our minimum loan is £3,000 and you could borrow up to a maximum of £20,000.

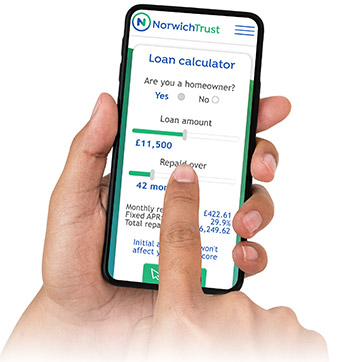

Repayment terms vary from 3 to 10 years, depending on the amount borrowed. You can find out the term options by selecting your required loan amount in our personal loan calculator.

Our personal loan interest rates range from 24.9% - 34.9%. Our rates are not based on your credit score but are instead based on the amount borrowed. You can see the rate you’ll get using our personal loan calculator.

You can only have one personal loan from Norwich Trust at a time. You may be able to borrow more and “top-up” your loan after 12 months, subject to meeting our eligibility and affordability criteria.

As our personal loans are unsecured, the application process is more straightforward than for some other loans. On average, our loans are paid out within a few days.

Our personal loans can be used for a variety of purposes such as consolidating debt, funding home improvements or purchasing a vehicle. We can also offer wedding loans, education loans and even medical loans.

We only offer single applications for our personal loans, but we do take household circumstances into consideration when assessing the affordability of the loan.

If you’re looking to repay your loan early, you can contact us to request a settlement figure. Please note, our loans are designed for long-term borrowing, meaning if you chose to settle early the balance may not have reduced by much.

Yes. At Norwich Trust, our application process is manual, meaning we take time to understand any credit issues and could still offer you a loan if you’ve had problems in the past.

Applying for a loan with us only requires a soft search which won’t impact your credit score. Once the loan has been paid out, we report the payment history of the loan to the credit reference agencies. Making late payments or missing payments could negatively impact your credit file.