Representative Example: £13,000 over 66 months, 34.9% APR fixed. Monthly payment £406.79. Annual interest rate 30.31% fixed. Interest payable £13,848.14. Total repayable £26,848.14.

Minimum repayment period: 36 months. Maximum repayment period: 120 months. Maximum APR 37.9%.

Homeowner loan uses

We offer loans for many purposes including...

Homeowner loans criteria

3 steps to applying for a Homeowner Loan

Complete the online application and authorise us to review your bank account transactions via Open Banking.

Complete an affordability assessment with a member of our lending team.

A few final checks and then we’ll transfer the loan funds.

Frequently asked questions about Homeowner Loans

A loan exclusively for people who own a property. But don’t worry, while we require applicants to be homeowners, our loans are not secured against your property.

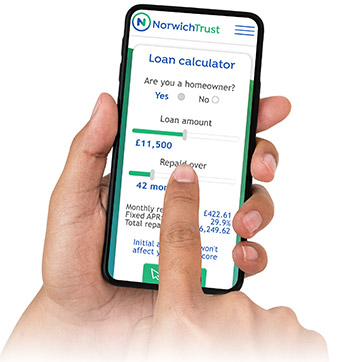

Norwich Trust offers loans from £3,000 up to £20,000. Our handy homeowner loan calculator lets you choose the loan amount and term that's right for you.

Our homeowner loan rates are based on the amount of money borrowed, not on your credit score. The rates shown on our homeowner loan calculator are real rates, meaning if you apply for a loan with us, the rate you see is the rate you’ll receive.

We offer various terms depending on the amount borrowed.

- Loans under £9,000 can be repaid over 3 to 5 years

- Loans of £9,000 up to £14,999 can be repaid over 3 to 8 years

- Loans of £15,000 and over can be spread over 3 to 10 years.

- If you’re looking to borrow £20,000, the minimum loan term is 4 years.

Our loan applications are more straightforward than secured loans meaning you could have the money in your account in just a few days.

We lend to customers for a variety of purposes including debt consolidation, home improvements, to purchase or repair a vehicle, or to fund a wedding.

We don’t charge any application or arrangement fees for taking out a loan with us. We’re also a direct lender so you won’t be charged any broker fees.

Yes. Our manual application process allows us to consider each case on its merits rather than letting a computer decide, meaning you could still get a homeowner loan if you’ve had credit problems in the past.

Yes but there may be early repayment charges for settling early. If you want to settle your loan in full, ask us for a settlement figure. Our loans are designed for long-term term borrowing, so choosing to settle the loan early may mean the balance has not reduced as much as you think, particularly in the first year.

You can pay up to three times your fixed monthly payment without any added fees.

If you want to pay more than this, please contact us, and we can let you know what fees may apply.